DemoTSMC

[this page | pdf | back links]

Function Description

Returns a vector using tri-segmented Monte Carlo (TSMC) that

contains three entries: Portfolio Value, Quantile and Control

Variate Variance Ratio.

This function provides a simplified demonstration of the

usefulness of tri-segmented Monte Carlo for valuing portfolios of assets and

liabilities and for calculating associated risk measures of these portfolios

For further details of TSMC, see Efficient

Monte Carlo simulation of portfolio value, value-at-risk and other portfolio

metrics or speak to your contact at Nematrian. Instead of applying all

simulations to a portfolio of exposures, the simulations are split into 3

subsets, (1) an “underlying”, (2) an “added” and (3) an “extended” simulation

set. The extended set is usually by far the largest of these three sets. Only

the underlying and added sets are actually applied to the portfolio; the

extended set is instead applied to only to a fast to evaluate approximation

derived principally from the underlying simulation set. The added simulation

set helps to correct for inaccuracies in this approximation.

The demonstration of TSMC provided by MnDemoTSMC assumes a

portfolio of 40 instruments which have specified strikes,  , and terms,

, and terms,  (see

MnDemoTSMCStrikes

and MnDemoTSMCTerms

for details) and relate to one of two specified indices,

(see

MnDemoTSMCStrikes

and MnDemoTSMCTerms

for details) and relate to one of two specified indices,  (see

MnDemoTSMCUnderlyings for details). We use

(see

MnDemoTSMCUnderlyings for details). We use  to

represent the value of the

to

represent the value of the  ’th index at time

’th index at time  . Each instrument

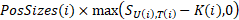

is a European-style call option so has payoff equal to

. Each instrument

is a European-style call option so has payoff equal to  . Instrument terms are all 1, 2, 3, 4 or 5 years. Users can

select the position sizes, i.e. PosSizes to apply to the portfolio.

. Instrument terms are all 1, 2, 3, 4 or 5 years. Users can

select the position sizes, i.e. PosSizes to apply to the portfolio.

The two indices are assumed to follow

independent log-normal (Brownian) motions with (constant) annualised

volatilities (cumulatively compounded) specified by the two entries of ImpliedVolatilities.

It is assumed that interest rates are zero at all times, making it practical to

value each instrument analytically using a Nematrian web function call along

the line of:

PosSizes(i) * MnBSCall(K(i), 1, 0, 0, 0, T(i), ImpliedVolatilities(U(i)))

Please note:

(a)

BaseSimulationsUandA: needs to be of size (nUnderlying + nAdded)

x 10 (i.e. 10 for each simulation, these corresponding to log returns in years

1-5 for first index and to log returns in years 1-5 for the second index

respectively

(b)

SimulationValuesUandA: needs to be of size (nUnderlying + nAdded)

(c)

DistanceScaling: this array defines the weights to give to different

dimensions in the calculation of the distance between two different points in

the underlying 10-dimensional space

(d)

This function is designed to provide a

simple demonstration of tri-segmented Monte Carlo. It therefore only considers

“run-off” VaRs/quantiles and does not aim to demonstrate other elements of

Nematrian’s full tri-segmented Monte Carlo engine such as 1-year / nested VaR calculations

and use of importance sampling.

NAVIGATION LINKS

Contents | Prev | Next

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Tri-segmented Monte Carlo Demonstration functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement