Blending Independent Components and

Principal Components Analysis

4.2 Different blended importance criteria

[this page | pdf | references | back links]

Return to

Abstract and Contents

Next page

4.2 Different blended

importance criteria

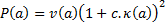

One possible approach would be to use an importance

criterion involving a function  that includes

both variance and factors like kurtosis that characterise the extent to which

the data seems to be coming from a non-normal distribution. For example, we might

use the following:

that includes

both variance and factors like kurtosis that characterise the extent to which

the data seems to be coming from a non-normal distribution. For example, we might

use the following:

(N.B. We could also use any function that varied

monotonically in line with this function, e.g. its square root , if  is positive,

and we would derive exactly the same input signals)

is positive,

and we would derive exactly the same input signals)

Here  is the variance

of the time series corresponding to the mixture of output signals characterised

by

is the variance

of the time series corresponding to the mixture of output signals characterised

by  ,

,  is its

kurtosis, and

is its

kurtosis, and  is a constant

that indicates the extent to which we want to focus on kurtosis rather than

variance in the derivation of which signals might be ‘important’. Again we

would constrain

is a constant

that indicates the extent to which we want to focus on kurtosis rather than

variance in the derivation of which signals might be ‘important’. Again we

would constrain  to be of ‘unit

length’, i.e. to have

to be of ‘unit

length’, i.e. to have  .

.

The larger (i.e. more positive)  is,

the more we might expect such an approach to tend to highlight signals that

exhibit positive kurtosis. Thus the closer the computed unmixed input signals

should be to those that would be derived by applying ICA to the mixed signals

(if the ICA was formulated using model pdfs with high kurtosis). We here need

to assume that

is,

the more we might expect such an approach to tend to highlight signals that

exhibit positive kurtosis. Thus the closer the computed unmixed input signals

should be to those that would be derived by applying ICA to the mixed signals

(if the ICA was formulated using model pdfs with high kurtosis). We here need

to assume that  does not vary

‘too much’ with respect to

does not vary

‘too much’ with respect to  , so that in

the limit as

, so that in

the limit as  any signal

exhibiting suitably positive kurtosis will be selected at some stage in the

iterative process, although we might expect variation in

any signal

exhibiting suitably positive kurtosis will be selected at some stage in the

iterative process, although we might expect variation in  to ‘blur’

together some signals that ICA might otherwise distinguish. The smaller (i.e.

closer to zero)

to ‘blur’

together some signals that ICA might otherwise distinguish. The smaller (i.e.

closer to zero)  is, the closer

the result should be to a PCA analysis.

is, the closer

the result should be to a PCA analysis.

However, there are several possible weaknesses with such an

approach:

(a) There is no

immediately obvious reason to choose any particular value of  .

This is because we have not introduced into the problem specification any

particular relative importance to ascribe to variance versus kurtosis. One

possible solution to this problem is to focus application of such a methodology

onto a problem that does potentially provide some guidance in this area. The

most obvious such application would be portfolio risk measurement in a

situation where we wanted to measure risk not by reference to variance of

relative return (or a monotonically equivalent measure such as standard

deviation) but by reference to some other metric such as Value-at-Risk or

Expected Shortfall that places greater weight on tail behaviour. We could for

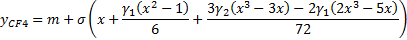

example ‘extrapolate’ into the tail based on observed variance and kurtosis

(and also skew) using the 4th order Cornish Fisher asymptotic

expansion. According to this expansion, we can estimate the quantile of a

distribution relative to that which would apply were the distribution to have

no skew or variance using the following formula, see e.g. Kemp (2009):

.

This is because we have not introduced into the problem specification any

particular relative importance to ascribe to variance versus kurtosis. One

possible solution to this problem is to focus application of such a methodology

onto a problem that does potentially provide some guidance in this area. The

most obvious such application would be portfolio risk measurement in a

situation where we wanted to measure risk not by reference to variance of

relative return (or a monotonically equivalent measure such as standard

deviation) but by reference to some other metric such as Value-at-Risk or

Expected Shortfall that places greater weight on tail behaviour. We could for

example ‘extrapolate’ into the tail based on observed variance and kurtosis

(and also skew) using the 4th order Cornish Fisher asymptotic

expansion. According to this expansion, we can estimate the quantile of a

distribution relative to that which would apply were the distribution to have

no skew or variance using the following formula, see e.g. Kemp (2009):

Here,  ,

,  is the skew of

the distribution and

is the skew of

the distribution and  is the

kurtosis of the distribution, where

is the

kurtosis of the distribution, where  is the

probability to which

is the

probability to which  applies and

applies and  is the inverse

normal distribution function.

is the inverse

normal distribution function.

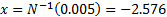

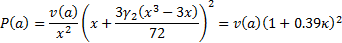

For example, we might adopt a 1 in 200

quantile cut-off, in which case  . For a

distribution with zero skew, we might thus apply an importance criterion that

sought to maximise:

. For a

distribution with zero skew, we might thus apply an importance criterion that

sought to maximise:

The physical interpretation of this is that, if these

assumptions apply, then the 1 in 200 quantile is a factor of  further into

the tail than we might otherwise expect purely from the standard deviation of

the distribution.

further into

the tail than we might otherwise expect purely from the standard deviation of

the distribution.

(b) Unfortunately, the 4th

order Cornish-Fisher expansion is not in general very good at estimating the

shape of the distributional form in regions in which we might be most

interested, see e.g. Kemp (2009).

In effect, the computation of skew and kurtosis gives ‘too much’ weight to the

extent of non-normality in the centre of the distributional form whereas

typically for risk management purposes we are most interested in the extent of

non-normality in the tail of the distribution. He proposes an alternative

approach, more directly akin to fitting a curve through the observed (ordered)

distributional form, to ‘extrapolate into the tail’.

Such an approach is more computationally

intensive than the Cornish-Fisher approach, particularly if the data series in

question involve a large number of terms. The approach requires the return

series to be sorted, in order to work out which observations to give most

weight to in the curve fitting algorithm. Sorting large data sets is

intrinsically much slower than merely calculating their moments since it

typically involves a number of computations that scales in line with

approximately  rather than

merely

rather than

merely  . It may be

that such a refinement would not in practice lead to a much enhanced risk

model, as non-zero kurtosis is still typically a good indicator of the presence

of fat-tailed behaviour, even if it is not a particularly good indicator of

exactly how fat-tailed it is in the particular part of the distributional form

in which we might be most interested.

. It may be

that such a refinement would not in practice lead to a much enhanced risk

model, as non-zero kurtosis is still typically a good indicator of the presence

of fat-tailed behaviour, even if it is not a particularly good indicator of

exactly how fat-tailed it is in the particular part of the distributional form

in which we might be most interested.

(c) More

problematic, perhaps, is another topic that Kemp explores in Kemp (2009) and

Kemp (2010).

He notes, as implicitly have earlier authors, that much of the fat-tailed

behaviour observed in practice in return series (both when viewed singly and

when viewed jointly) seems to derive from time-varying volatility, see Section

4.3.

NAVIGATION LINKS

Contents | Prev | Next