Clustering techniques for universe

selection

[this page | pdf | references | back links]

Example Cluster Analysis

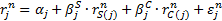

(click on chart for more details)

1.

Cluster analysis is a well-established tool in quantitative

finance. We might for example want to know which stocks appear to behave most

‘similarly’ to which other stocks, thus grouping together stocks that appear to

have similar economic characteristics. Market index data vendors often classify

stocks according to some predefined industry classification, but not all stocks

easily fit into such classifications. Even if they did, which industry

sub-types should be grouped together to form overall industry sectors? Also, is

it better to analyse stocks by country first and then sector or vice-versa?

Etc.

2.

Most types of cluster analysis used in finance involve hierarchical

clustering. This can be thought of as a form of unsupervised learning.

We have some information about individual elements and we want to build up a

nested tree that best characterises the degree of linkage between the different

elements (without presupposing any ‘right answer’ in advance). For example, we

might have a series of stock or sector returns, and we want to see which ones

appear to be closest to each other. The output is a bunch of fully nested sets.

The smallest sets are the individual elements themselves. The largest set is

the whole data set. The intermediate sets are nested, i.e. the intersection of

any two sets is either the null set or the smaller of the two sets.

3.

The common convention is to have the nesting arrangement form a binary

tree, i.e. where each larger set is deemed to split into just two

sub-sets at each node of the tree. Where say three subsets are equally near

each other within a larger set then this is typically represented by an

arbitrary choice of one of the three subsets to stand distinct and for a branch

of zero length to join it to the join of the other two subsets.

4.

For example, quantitative equity research analysts might focus on

correlations between different regional sectors and correlations of stocks

within sectors, computed using regression analyses over over suitable rolling

periods, computing sector and country betas from the following formula, see

e.g. Morgan

Stanley (2002):

where:  is

return of stock

is

return of stock  in month

in month  ,

,  is

return of sector

is

return of sector  in month

in month  ,

,  is

return of country

is

return of country  in month

in month  ,

,  and

and  are sector

and country of stock

are sector

and country of stock  and

and  is

unexplained return of stock

is

unexplained return of stock  in month

in month

5.

Precise choice of how to measure ‘degree of linkage’, i.e. the ‘distance’

between different elements, can be quite important in this context, and can

depend on what question we are trying to answer. For example, in an equity

orientated analysis as above, we might measure ‘distance’ either by reference

to correlations or by reference to covariances. If we use covariances then

relatively unvolatile stocks will be deemed to be relatively similar whilst

relatively volatile stocks may be deemed to be relatively different to each

other even when they are relatively highly correlated. The algorithm used to

derive the example cluster analysis shown above is based on one in Press et al.

(2007).

References

Morgan

Stanley (2002). Quantitative Strategies Research Note. Morgan Stanley

Press, W.H.,

Teukolsky, S.A., Vetterling, W.T. and Flannery, B.P. (2007). Numerical

Recipes: The Art of Scientific Computing. Cambridge University Press