PFProjectBenefitsProbDefault

[this page | pdf | back links]

Function Description

Returns an array showing the probability of sponsor default

over any given year in a pension fund projection.

If FactorDefaultAdjParam and WindUpDefaultAdjParam

are both zero then the computations are very straightforward, depending only on

BaseSponsorDefaultRates.

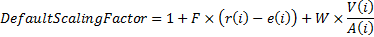

However, if FactorDefaultAdjParam or WindUpDefaultAdjParam

are non-zero then the probability of default is adjusted from the above in a

manner that reflecting the progression of the FactorDrivingDefault or by

how well funded on a discontinuance basis the scheme is projected to be at

future points in time, by applying a scaling factor to BaseSponsorDefaultRates

(min 0, max 1) defined as follows:

where: i = year in projection, F = FactorDefaultAdjParam,

r(i) = Actual return (movement) on Factor Driving Default(i),

e(i) = Expected return on Factor Driving Default(i), W

= WindUpDefaultAdjParam, V(i) = TotalBenefitValue(i)

(on a windup basis), A(i) = Total Asset Value(i)

(values of r(i), e(i), V(i)

and A(i) are computed using Nematrian’s approximate pension

projection algorithms)

NAVIGATION LINKS

Contents | Prev | Next

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Cash-Flow Projection functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement